Protect Your Identity this Tax Season

Taxes are due April 15, and as busy professionals work to complete their tax returns, cybercriminals are stepping up their identity theft efforts. First Security Bank wants to make sure consumers know how to spot potential identity theft scams this tax season.

“It’s easy to let your guard down during a busy time like tax season,” said Lyndsay Clark, VP/Retail Banking Manager. “Cybercriminals take advantage of this, so it’s important to be alert to the types of fraud that are common this time of year.”

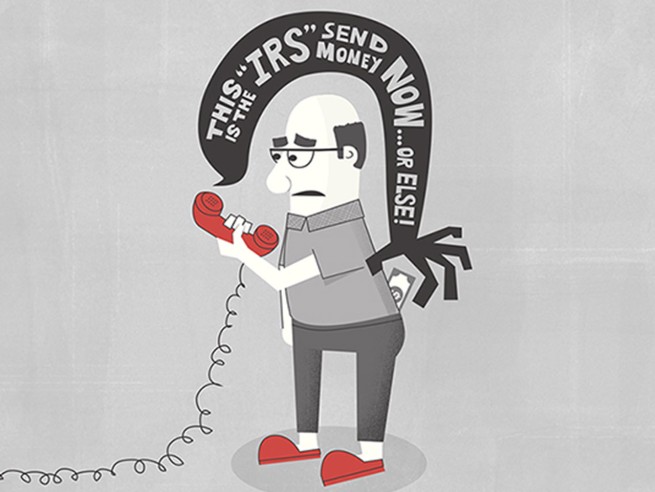

IRS impersonation scams involve phone calls or emails from someone claiming to work for the IRS. They may tell the victim that there is an issue with their tax return or that they need to update tax filing information.

Following are tips on how to spot these scams.

- Don’t trust emails or phone calls. The IRS will not contact you by email or by phone to confirm information on your tax return. Ignore any such communications, and report suspected IRS impersonation scams to the IRS.

- Protect your Social Security number. If a criminal obtains your SSN, they can do a lot of damage to your identity, including filing a false tax return in your name. Keep your Social Security card locked in a safe place, and never give your SSN to anyone on the phone or in an email.

- Do NOT click on suspicious email links or download attachments. Criminals will use phishing scams as one method to commit tax fraud. They may send emails that contain malicious links or attachments that will install malware on your computer. Report any tax-related phishing attempts to phishing@IRS.gov.

- Install anti-virus software on your computer to help detect viruses and malware.

- Shred any documents containing sensitive personal information, such as Social Security numbers, bank account information and unused credit card offers.

What to Do If You Have Been Victimized

If you believe you are a victim of a tax-related scam, take the following steps to remedy the situation.

- Contact the IRS immediately and complete an Identity Theft Affidavit.

- File a complaint with the Federal Trade Commission at identitytheft.org.

- Place a fraud alert on your credit records.

- Examine your credit report and take steps to close any accounts opened without your permission.

- Monitor your financial accounts to make sure they have not been compromised, and report any suspicious activity to the corresponding financial institution.

Learn more on the IRS website.