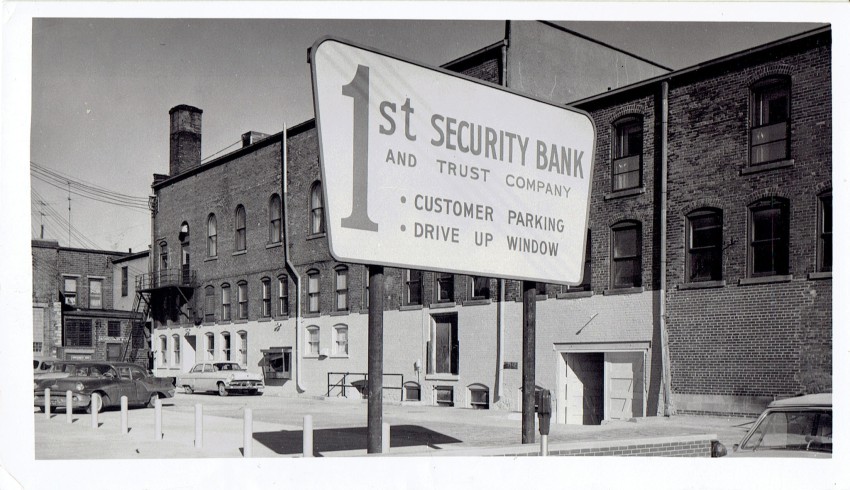

Our 120+ year history is a testament to First Security being a safe place to conduct business. We have bounced back from multiple local, national, and worldwide events - whether it was the Great Depression or a hundred-year flood.

Cybersecurity and Fraud Prevention

Protecting our customers' information and funds is a top priority at First Security. We employ multiple layers of security and follow strict privacy regulations. Some tools we use include: encryption, multi-factor authentication, firewalls, regular security audits, and fraud detection systems. Our employees also constantly receive training on fraud detection. Learn more about this topic, how you can protect yourself, and the other fraud prevention tools we offer by visiting our security page.

Strong Capital Position

Our strong capital position means we have an excess of the funds used to support the bank as we make loans and investments in our community. Our bank is managed conservatively and is considered "Well Capitalized" by the agencies that regulate us.

Multiple Funding Sources

Funding is critical to the bank as it allows us to pay our depositors, fund loans to our borrowers, and provides an additional safety net. While we rely on depositors for funding, we also have access to many other sources like the Federal Home Loan Bank and the Federal Reserve. We manage this funding daily to ensure we protect our customers, the community, as well as the bank. Our funding level exceeds regulatory expectations.

FDIC Insurance

Each depositor is insured up to $250,000.00, and no depositor in the history of the Federal Deposit Insurance Corporation (FDIC) has lost a cent of insured deposits.

The FDIC has an Electronic Deposit Insurance Estimator (EDIE) tool that allows users to determine what amount of their deposits are covered and what portion, if any, is above the coverage limits. Use that tool here: EDIE Calculator

There are also ways to increase coverage beyond the FDIC limit. Our staff can help you learn how to do that.

Understanding Deposit Insurance

Local Roots

Our shareholders have roots in our community and are here to support it. To that point, the majority of our loans and investments are made in the immediate region. These loans support small businesses, livelihoods, provide for the purchase of homes, farms, and the things that our neighbors need to live rich, vibrant lives and make our local economy prosper. For us to continue to serve our community in this way, we must manage the bank in a conservative and responsible manner. We have done this for over 120 years and will for generations to come.

Still have questions?

Feel free to reach out, and we'll gladly connect you with the right expert to address your questions.