You Should Know: Your Bank Isn't Asking About an Extended Warranty

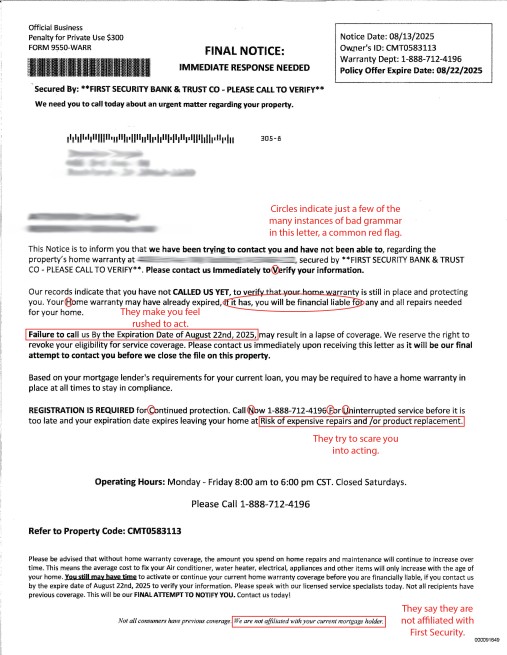

If you’re like most people, you’ve probably received multiple postcards and letters in the mail over the years regarding extending your home or car warranty. Most of the time, you consider it spam and toss it along with the rest of your junk mail. However, sometimes these postcards list your financial institution, maybe even First Security as an affiliated company. They make you pause and wonder if it’s legitimate. Hopefully at that point you call your bank to ask some questions. You will likely learn these extended warranty offers are not affiliated with your bank.

How does this happen? How did a strange company learn your bank’s name and that you recently received a mortgage or car loan?

The answer is companies that offer these warranties and other services like credit cards or insurance, will often purchase sales leads from consumer credit reporting agencies (Equifax, TransUnion, and Experian). They develop a list of criteria for the people they want to advertise to, such as type of credit history or credit score. The credit bureau agency then puts together a list of contacts and sells it to the company.

We see this often in solicitations for preapprovals of credit cards. However, as mentioned previously, there are other forms of solicitation. If the company buys information about people who recently opened a mortgage loan or car loan, they could use that list to send advertisements for a home or car warranty. If their data shows someone has had a mortgage for a while, they might send advertisements about refinancing.

Another piece of information these companies can obtain is the name of the bank someone has a loan through. This is how advertisements can be worded in a way that make them appear as if they are affiliated with First Security or whichever bank provided the loan.

Unfortunately, some recipients may be deceived and believe that the company sending the mail is affiliated with their personal financial institution when it is not. Additionally, recipients may believe their bank has sold or provided their loan and other financial information to a third party.

Rest assured, First Security Bank does not sell customer information to non-affiliated third parties and we do not provide loan information to parties other than credit reporting agencies. To read more about how First Security handles your information, you can read our privacy policy here.

So, what can you do to stop these types of solicitations? You can visit the Federal Trade Commission (FTC) website where there’s more information about prescreened solicitations and the process of opting out of information sharing.

Starting this process will have you well on your way to a cleaner mailbox and fewer pieces of potentially deceiving mail. If you’re ever in doubt, please call us at 1.800.272.0159 and we’ll be happy to hear your concerns and answer your questions.